The business environment in the United States is highly attractive, favored by many international investors and entrepreneurs for its accessibility and flexibility. Specifically, when a resident of Japan owns a U.S. Limited Liability Company (LLC), there are certain tax reporting obligations involved. This blog post focuses on the requirements for filing Form 5472, explaining its details and importance.

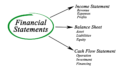

What is Form 5472?

Form 5472, “Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business,” is a form required by the IRS (Internal Revenue Service). It must be filed when a U.S. corporation or LLC is at least 25% foreign-owned, or when a foreign corporation is engaged in a trade or business within the U.S. This form helps U.S. and foreign tax authorities better monitor international transactions and tax flows.

Filing Obligations for LLCs Owned by Japanese Residents

Even if a U.S. LLC is considered a “transparent” tax entity (meaning its income is attributed directly to its owners), it must file Form 5472 if it has foreign owners, including residents of Japan, and engages in “trade or business” within the U.S. The critical point is that if the LLC conducts business in the U.S., it is required to file this form.

How and When to File Form 5472

For Disregarded Entities

If an LLC is owned by a single foreign person and treated as a Disregarded Entity for tax purposes, it must file Form 5472. In this case, the LLC is considered non-existent for tax purposes, and all income and expenses are directly attributed to the owner. However, Form 5472 is necessary to report transactions with foreign related parties if the foreign owner conducts “trade or business” through the U.S. LLC. It should be attached to Form 1120 (U.S. Corporation Income Tax Return) and filed under the LLC’s name by April 15th.

For Partnerships

If an LLC elects to be treated as a partnership (with multiple members, for instance), Form 5472 might be required, especially if the partnership has a direct or indirect foreign owner holding at least 25%, or if a foreign partnership engages in trade or business within the U.S. In this case, Form 5472 is filed alongside Form 1065 (U.S. Return of Partnership Income). The deadline for submission is the 15th day of the fourth month following the end of the fiscal year.

For C-Corporations

If an LLC opts for C Corporation tax status, Form 5472 must be attached to Form 1120 and submitted by the 15th day of the fourth month following the end of the fiscal year.

Extension Applications

If an extension is needed, Form 7004 can be used to automatically obtain a six-month extension. Generally, for those adopting a calendar year (ending December 31), the extension moves the deadline from April 15 to October 15, but Form 7004 must be filed by April 15.

Other Filing Scenarios for Form 5472

Form 5472 is also required in the following scenarios:

- When a foreign corporation owns real estate in the United States.

- When a U.S. corporation engages in monetary transactions with a foreign corporation (for example, providing loans or paying dividends).

Penalties for Non-Filing of Form 5472

If Form 5472 is not filed, filed incompletely, or filed late, the IRS (Internal Revenue Service) may impose substantial fines. Specifically, the following penalties apply:

- Basic Penalty: If Form 5472 is not filed, a penalty of $25,000 is imposed for each unfiled Form 5472.

- Additional Penalty: After the initial penalty, an additional $25,000 is added every 90 days until the filing is completed. This additional penalty starts after the notification from the IRS and can increase up to a maximum of $25,000.

To Avoid Penalties

- Accurate Record Keeping: Keep precise records of all transactions with foreign related parties to ensure that the necessary information is completely and accurately reflected on Form 5472.

- Timely Filing: Form 5472 must be filed within the deadline along with the associated corporate tax return (such as Form 1120). If the deadline is approaching, consider applying for an extension.

- Professional Advice: Form 5472 is complex and prone to errors, making it essential to seek advice and support from a tax professional.

Summary

I have explained the filing requirements for Form 5472 for residents of Japan who own a U.S. LLC. Form 5472 is essential for maintaining transparency in international transactions for U.S. LLCs with foreign ownership or commercial activities. To determine whether there is a filing obligation, it is important to accurately understand the tax status, ownership structure, and business activities of the LLC. Delays in filing or improper filings may result in substantial penalties, thus timely and proper submission is required. Tax reporting requires careful attention, so it is advisable to consult with a professional if there are any uncertainties. Receiving appropriate advice can help avoid penalties and facilitate a smooth tax process.

Comment