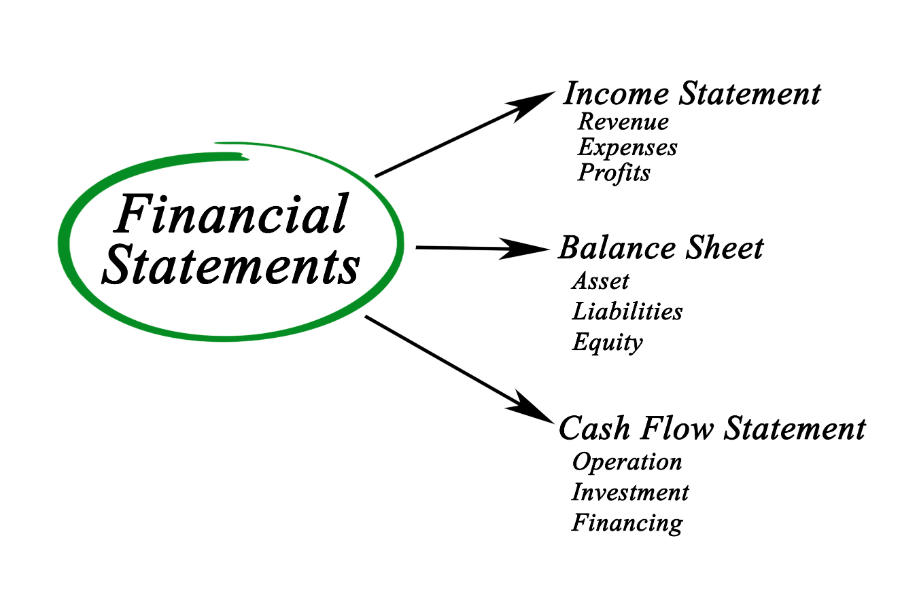

For business owners operating in the United States, accurately understanding their company’s financial status is an essential element in formulating business strategies. In particular, the Balance Sheet, Income Statement, and Cash Flow Statement are important indicators of the health of your business. This article will explain the role of these financial statements and why daily accounting is important. We will also touch on the relationship and differences between financial statements and year-end corporate tax returns (LLC, S-Corp, C-Corop, Partnership).

What are financial statements?

The main financial statements, the balance sheet, income statement, and cash flow statement, each contain different information and provide important indicators for assessing the health of a business along with the periods they cover.

Balance Sheet

Main accounts:

- Assets: cash, accounts receivable, inventory, fixed assets, etc.

- Liabilities: accounts payable, loans payable, taxes payable, etc.

- Equity capital: share capital, surplus, carried forward profits, etc.

Period shown:

A balance sheet provides a snapshot at a fixed date. For example, it reflects the financial position of a business at the end of a year or quarter.

What it means for business owners:

This document allows you to see the balance of your business’ assets and liabilities. For example, high fixed assets indicate large investments, and high accounts payable means high payment obligations. A company’s financial stability can be evaluated from this balance.

Meaning of accounting:

Balance sheet accounts carry over from one year to the next and are tracked continuously. This allows for long-term management of assets such as fixed assets, which can become significantly more difficult to manage over time if they are not accurately recorded from the start of the business.

How much did the business owner invest in the first year? Also, how much additional investment did you make in the next year? Such information is important data required when filing corporate tax returns, and accurate records are required.

Income Statement

Main accounts:

- Revenue: Product sales revenue, service revenue, etc.

- Expenses: Cost of sales, personnel expenses, advertising expenses, lease fees, etc.

Period shown:

An income statement shows revenues and expenses for a specific period of time (usually a year or a quarter).

What it means for business owners:

The income statement shows the company’s profitability during the period. For example, if revenues are increasing but expenses are also increasing, you can analyze changes in profit margins and consider future cost reductions.

Meaning of accounting:

You need to make sure that the expenses are recognized as business expenses when recording them. In particular, you need to check whether travel expenses, entertainment expenses, meal expenses, etc. can be recognized as business expenses. If it qualifies as a business expense, you may need to record information such as the purpose of your business. In addition, even if expenses are recognized as expenses in accounting terms, some deductions may not be allowed in corporate tax returns. You need to know which expenses are not allowed to be deducted before preparing your corporate tax return.

Cash Flow Statement

Main accounts:

- Cash flow from operating activities: cash obtained from sales, cash used for payments

- Cash flow from investment activities: Cash flow from capital investment and buying and selling of securities.

- Cash flow from financing activities: Cash flow from issuing stocks and borrowings

Period shown:

This statement, similar to an income statement, shows cash flows for a specific period (year or quarter).

What it means for business owners:

The cash flow statement allows you to see the actual changes in cash. This allows you to determine whether your cash flow is sound and make plans for raising funds or investing if necessary.

Meaning of accounting:

Cash is essential to sustaining your business. If you don’t have enough cash, you won’t be able to pay your employees. In daily business operations, it is necessary to always keep an eye on how much cash you currently have on hand.

Difference between financial statements and corporate tax return

A company’s financial statements and corporate tax returns are both important documents for recording and reporting a company’s financial situation, but they have different purposes, content, and users. The main differences are explained below.

Difference in purpose:

- Financial statements: reflect a company’s financial position, results of operations, and cash flows and are intended to provide information to stakeholders such as investors and creditors.

- Corporate tax return: Reports the amount of tax paid according to the tax law and pays the appropriate tax to the government. Through this declaration, companies report their income, deductions, credits, etc.

Differences in standards:

- Financial statements: Prepared based on Generally Accepted Accounting Principles (GAAP). This requires companies to accurately reflect economic reality.

- Corporate tax returns: Prepared based on tax laws, which often differ from accounting principles. For example, depreciation methods may differ between accounting standards and tax laws.

Differences in reporting periods:

- Financial statements: Usually prepared quarterly or annually.

- Corporate tax returns: Must be filed once a year by a specific deadline.

Degree of disclosure:

- Financial statements: Publicly traded companies must publicly disclose these, but private companies do not necessarily have to.

- Corporate tax returns: Business owners and companies file these with the government, but they are not available to the public.

Summary

For business owners operating in the United States, understanding financial statements and the accuracy of day-to-day accounting is critical. Through balance sheets, income statements, and cash flow statements, we provide a foundation for understanding the financial status, operating results, and flow of funds of a business and making appropriate decisions. These financial statements also play an important role in corporate tax filings and are essential to ensure accurate tax reporting and payment in accordance with tax laws. In order to support business sustainability and growth, it is necessary to acquire and appropriately utilize these financial management techniques.

Comment