We will compare the median rent in major metropolitan areas in 2023 (as of September 2023), individual income tax, and sales tax for the top 10 states in the United States with the largest number of Japanese residents. I hope this will be helpful for those who are planning to live in the United States. Tax rate information is based on information from each state’s tax authority.

California

Median rent in major metropolitan areas

Los Angeles Metropolitan Area:

The Los Angeles metropolitan area is California’s most populous region, centered around the city of Los Angeles. It is the center of the entertainment industry and home to Hollywood. The median monthly rent in the Los Angeles metropolitan area, which includes Los Angeles, Long Beach, and Anaheim, is $3,655.

San Francisco Bay Area:

The San Francisco Bay Area is a metropolitan area consisting of the city of San Francisco and its surrounding areas. Silicon Valley (high technology industrial area) is located there, and many technology companies are gathered there. The median monthly rent in the San Francisco Bay Area, which includes Oakland, San Jose, and Berkeley, is $3,807.

San Diego Metropolitan Area:

The San Diego metropolitan area is located in southern California, near the Mexican border. It is characterized by beautiful beaches and a warm climate and has a thriving tourism industry. The median monthly rent centered around the city of San Diego and including Carlsbad, Escondido, and Chula Vista is $3,576.

Income Tax

California’s individual income tax rates are as follows: The top tax rate will reach 12.3% in 2023, placing a heavy tax burden on high-income earners. On the other hand, there is also a tax rate for low-income earners, and the tax rate is applied in nine stages depending on income. California income taxes are paid to the Franchise Tax Board.

| Tax rate | Single / Married filing separately | Income tax |

| 1% | $0 to $10,099. | 1% of taxable income. |

| 2% | $10,100 to $23,942. | $100.99 plus 2% of the amount over $10,099. |

| 4% | $23,943 to $37,788. | $377.85 plus 4% of the amount over $23,942. |

| 6% | $37,789 to $52,455. | $931.69 plus 6% of the amount over $37,788. |

| 8% | $52,456 to $66,295. | $1,811.71 plus 8% of the amount over $52,455. |

| 9.3% | $66,296 to $338,639. | $2,918.91 plus 9.3% of the amount over $66,295. |

| 10.3% | $338,640 to $406,364. | $28,246.90 plus 10.3% of the amount over $338,639. |

| 11.3% | $406,365 to $677,275. | $35,222.58 plus 11.3% of the amount over $406,364. |

| 12.3% | $677,276 or more. | $65,835.52 plus 12.3% of the amount over $677,275. |

| Tax rate | Married filing jointly | Income tax |

| 1% | $0 to $20,198. | 1% of taxable income. |

| 2% | $20,199 to $47,884. | $201.98 plus 2% of the amount over $20,198. |

| 4% | $47,885 to $75,576. | $755.70 plus 4% of the amount over $47,884. |

| 6% | $75,577 to $104,910. | $1,863.38 plus 6% of the amount over $75,576. |

| 8% | $104,911 to $132,590. | $3,623.42 plus 8% of the amount over $104,910. |

| 9.3% | $132,591 to $677,278. | $5,837.82 plus 9.3% of the amount over $132,590. |

| 10.3% | $677,279 to $812,728. | $56,493.80 plus 10.3% of the amount over $677,278. |

| 11.3% | $812,729 to $1,354,550. | $70,445.15 plus 11.3% of the amount over $812,728. |

| 12.3% | $1,354,551 or more. | $131,671.04 plus 12.3% of the amount over $1,354,550. |

Sales Tax

In California, sales tax is levied on most goods and some services within the state. Sales tax rates are not uniform across the state and may vary from municipality to municipality. Therefore, if you shop in different locations within California, your sales tax rate will be different. The general sales tax rate is approximately 7.25%, but certain regions and counties may add additional local sales taxes that can bring the total sales tax rate to 8% or more.

California sales tax information is available from the California Department of Tax and Fee Administration.

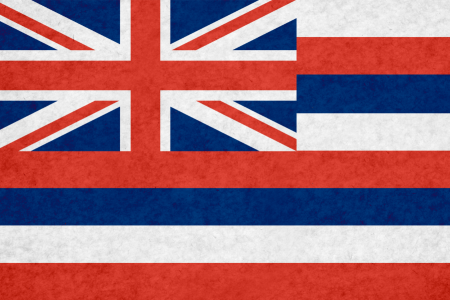

Hawaii

Median rent in major metropolitan areas

Honolulu Metropolitan Area:

Honolulu is the capital of the state of Hawaii and the largest and most populous city. Located on the south coast of Oahu, it is also the largest metropolitan area on the island. Honolulu International Airport is also located in the area and is an important international access point to the state. Waikiki Beach is famous for its thriving tourism and commerce industry. The median monthly rent in Honolulu is $2,650.

Income Tax

The individual income tax rates in Hawaii are as follows: The top tax rate in 2023 is 11%. Hawaii state income taxes are paid to the Hawaii Department of Taxation.

| Tax rate | Single / Married filing separately | Income tax |

| 1.40% | $0 to $2,400 | 1.4% of taxable income |

| 3.20% | $2,401 to $4,800 | $34 plus 3.20% over $2,400 |

| 5.50% | $4,801 to $9,600 | $110 plus 5.50% over $4,800 |

| 6.40% | $9,601 to $14,400 | $374 plus 6.40% over $9,600 |

| 6.80% | $14,401 to $19,200 | $682 plus 6.80% over $14,400 |

| 7.20% | $19,201 to $24,000 | $1,008 plus 7.20% over $19,200 |

| 7.60% | $24,001 to $36,000 | $1,354 plus 7.60% over $24,000 |

| 7.90% | $36,001 to $48,000 | $2,266 plus 7.90% over $36,000 |

| 8.25% | $48,001 to $150,000 | $3,214 plus 8.25% over $48,000 |

| 9% | $150,001 to $175,000 | $11,629 plus 9.00% over $150,000 |

| 10% | $175,001 to $200,000 | $13,879 plus 10.00% over $175,000 |

| 11% | $200,001 or more | $16,379 plus 11.00% over $200,000 |

| Tax rate | Married filing jointly | Income tax |

| 1.40% | $0 to $4,800 | 1.4% of taxable income |

| 3.20% | $4,801 to $9,600 | $67 plus 3.20% over $4,800 |

| 5.50% | $9,601 to $19,200 | $221 plus 5.50% over $9,600 |

| 6.40% | $19,201 to $28,800 | $749 plus 6.40% over $19,200 |

| 6.80% | $28,801 to $38,400 | $1,363 plus 6.80% over $28,800 |

| 7.20% | $38,401 to $48,000 | $2,016 plus 7.20% over $38,400 |

| 7.60% | $48,001 to $ $72,000 | $2,707 plus 7.60% over $48,000 |

| 7.90% | $72,001 to $96,000 | $4,531 plus 7.90% over $72,000 |

| 8.25% | $96,001 to $300,000 | $6,427 plus 8.25% over $96,000 |

| 9% | $300,001 to $350,000 | $23,257 plus 9.00% over $300,000 |

| 10% | $350,001 to $400,000 | $27,757 plus 10.00% over $350,000 |

| 11% | $400,001 or more | $32,757 plus 11.00% over $400,000 |

General Excise Tax, GET

Hawaii has no sales tax. Instead, there is a GET evaluated for all business activities. The tax rates are 0.15% on insurance commissions, 0.5% on imports for wholesale, manufacturing, production, wholesale services, and resale purposes, and 4% on everything else.

Hawaii General Excise Tax (GET) information is available from the Hawaii Department of Taxation.

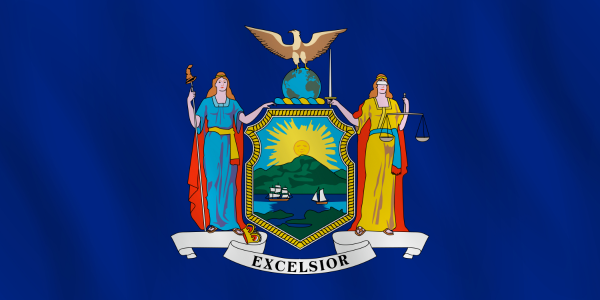

New York

Median rent in major metropolitan areas

New York City Metropolitan Area:

The New York City metropolitan area is a huge metropolitan area centered around New York City, and is one of the most populous metropolitan areas in the United States. New York City itself is made up of five boroughs: Manhattan, Brooklyn, Queens, the Bronx, and Staten Island. This metropolitan area is known as a cosmopolitan city with many famous tourist attractions, cultural institutions, financial institutions, and businesses. Median monthly rent in New York City, Newark (NJ), and Jersey City (NJ) is $4,399.

Income Tax

The individual income tax rates in New York State are as follows: The top tax rate in 2023 is 10.90%.

New York State income taxes are paid to the New York State Department of Taxation and Finance.

| Tax rate | Single/Married filing separately | Income tax |

| 4% | $0 to $8,500. | 4% of taxable income. |

| 4.5% | $8,501 to $11,700. | $340 plus 4.5% of the amount over $8,500. |

| 5.25% | $11,701 to $13,900. | $484 plus 5.25% of the amount over $11,700. |

| 5.85% | $13,901 to $80,650. | $600 plus 5.85% of the amount over $13,900. |

| 6.25% | $80,651 to $215,400. | $4,504 plus 6.25% of the amount over $80,650. |

| 6.85% | $215,401 to $1,077,550. | $12,926 plus 6.85% of the amount over $215,400. |

| 9.65% | $1,077,551 to $5,000,000. | $71,984 plus 9.65% of the amount over $1,077,550. |

| 10.30% | $5,000,001 to $25,000,000. | $450,500 plus 10.30% of the amount over $5,000,000. |

| 10.90% | $25,000,001 and over. | $2,510,500 plus 10.90% of the amount over $25,000,000. |

| Tax rate | Married filing jointly | Income tax |

| 4% | $0 to $17,150. | 4% of taxable income. |

| 4.5% | $17,151 to $23,600. | $686 plus 4.5% of the amount over $17,150. |

| 5.25% | $23,601 to $27,900. | $976 plus 5.25% of the amount over $23,600. |

| 5.85% | $27,901 to $161,550. | $1,202 plus 5.85% of the amount over $27,900. |

| 6.25% | $161,551 to $323,200. | $9,021 plus 6.25% of the amount over $161,550. |

| 6.85% | $323,201 to $2,155,350. | $19,124 plus 6.85% of the amount over $323,200. |

| 9.65% | $2,155,351 to $5,000,000. | $144,626 plus 9.65% of the amount over $2,155,350. |

| 10.30% | $5,000,001 to $25,000,000. | $419,135 plus 10.30% of the amount over $5,000,000. |

| 10.90% | $25,000,001 and over. | $2,479,135 plus 10.90% of the amount over $25,000,000. |

If you live in New York City, you must also pay city income taxes.

Sales Tax

New York State imposes sales or use tax on most goods and some services within the state. The sales and use tax rate in New York State is the 4% statewide rate plus the local tax rate in effect in the jurisdiction (city, county, or school district) in which the sale or other transaction or use occurs.

The local sales and use tax rate in New York City is 4.5%.

New York State sales and use tax information is available from the New York State Department of Taxation and Finance.

Washington

Median rent in major metropolitan areas

Seattle Metropolitan Area:

Seattle is the largest and most important city in Washington state, centered on the Seattle metropolitan area. Seattle is home to technology companies (particularly Microsoft and Amazon), the aerospace industry (Boeing), and tourism. The city also has many cultural institutions, museums, a music scene, and natural landscapes (Puget Sound, Olympic Mountains, and Cascade Mountains). The median monthly rent in Seattle, Tacoma, and Bellevue is $2,970.

Income Tax

Washington state does not impose individual income taxes. This means that individuals living in Washington state do not have to pay state income taxes. However, federal income tax still applies.

Sales Tax

In Washington state, sales or use tax is levied on consumer goods and services. Sales tax rates are not uniform across the state and vary by municipality. The basic sales tax rate in Washington state is 6.5%.

The City of Seattle’s 2023 sales and use tax rate is 10.25%. This is the sum of state, county, and city sales tax rates. This includes the Washington state sales tax rate of 6.5%, the county sales tax rate of 0%, and the city sales tax rate of 3.75%.

Washington state’s absence of an income tax has given sales tax an important role in the state’s tax structure.

Washington state sales and use taxes are paid to the Department of Revenue Washington State.

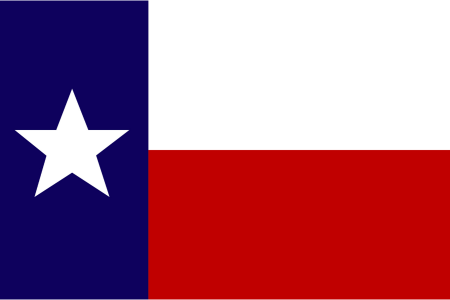

Texas

Median rent in major metropolitan areas

Houston Metropolitan Area:

Houston is the largest city in Texas and is home to many thriving industries, including the oil and gas, aerospace, and medical industries. Home to the Kennedy Space Center and the Texas Medical Center, medical research and space-related activities take place. It also features diverse culture, cuisine, and art. The median monthly rent in Houston, The Woodlands, and Sugar Land is $1,733.

Dallas-Fort Worth Metropolitan Area:

Dallas and Fort Worth are two large metropolitan areas connected together. The region is Texas’ business hub, home to many industries including technology, finance, aerospace, energy, and healthcare. Dallas-Fort Worth International Airport is one of the busiest airports in the United States. The median monthly rent in Dallas, Fort Worth, and Arlington is $2,149.

Income Tax

Texas does not impose individual income taxes. This means that individuals living in Texas do not have to pay state income taxes. However, federal income tax still applies.

Sales Tax

In Texas, sales or use tax is levied on goods and services. Sales and use tax rates are not uniform across the state and vary by municipality. The sales and use tax rate in Texas is 6.25%, and local taxing jurisdictions (cities, counties, special purpose districts, transportation authorities) are also subject to sales and use taxes of up to 2%. Combining the state sales tax rate with the local taxing jurisdiction’s sales tax rate, the highest sales tax rate in Texas is 8.25% in the cities of Houston, Dallas, San Antonio, Austin, and Fort Worth.

Texas’ absence of an income tax means that taxation is focused on consumption within the state.

Texas sales and use tax information is available at COMPTROLLER.TEXAS.GOV.

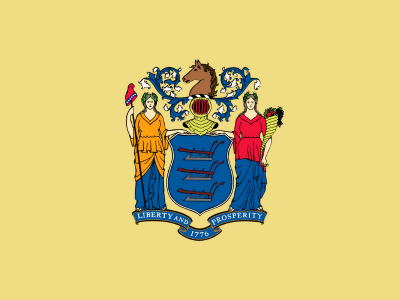

New Jersey

Median rent in major metropolitan areas

New York-New Jersey Metropolitan Area:

New Jersey is widely considered part of New York City, and the metropolitan area that includes both states is one of the largest and most populous metropolitan areas in the United States. In addition to the five boroughs of New York City (Manhattan, Brooklyn, Queens, Bronx, and Staten Island), there are many cities within New Jersey. Some of the major metropolitan areas include Jersey City, Newark, Elizabeth, Paterson, and Trenton. It is known as a cosmopolitan city with thriving financial, commercial, cultural and tourist industries. Median monthly rent in New York City (NY), Newark, and Jersey City is $4,399.

Income Tax

The individual income tax rates in New Jersey are as follows: The top tax rate in 2023 is 10.75%.

New Jersey state income tax information is available from the NJ Treasury Division of Taxation.

| Tax rate | Single/Married filing separately | Income tax |

| 1.4% | $0 to $20,000 | taxable income x 1.4% |

| 1.75% | $20,001 to $35,000 | taxable income x 1.75% minus $70.00 |

| 3.5% | $35,001 to $40,000 | taxable income x 3.5% minus $682.50 |

| 5.525% | $40,001 to $75,000 | taxable income x 5.525% minus $1,492.50 |

| 6.37% | $75,001 to $500,000 | taxable income x 6.37% minus $2,126.25 |

| 8.97% | $500,001 to $1 million | taxable income x 8.97% minus 15,126.25 |

| 10.75% | Over $1 million | taxable income x 10.75% minus 32,926.25 |

| Tax rate | Married filing jointly | Income tax |

| 1.4% | $0 to $20,000 | taxable income x 1.4% |

| 1.75% | $20,001 to $50,000 | taxable income x 1.75% minus $70.00 |

| 2.45% | $50,001 to $70,000 | taxable income x 2.45% minus $420.00 |

| 3.5% | $70,001 to $80,000 | taxable income x 3.5% minus $1,154.50 |

| 5.525% | $80,001 to $150,000 | taxable income x 5.525% minus $2,775.00 |

| 6.37% | $151,000 to $500,000 | taxable income x 6.37% minus $4,042.50 |

| 8.97% | $500,001 to $1 million | taxable income x 8.97% minus $17,042.50 |

| 10.75% | Over $1 million | taxable income x 10.75% minus $34,842.50 |

Sales Tax

New Jersey imposes a 6.625% sales tax on the sale of most tangible personal property, certain digital products, and certain services unless specifically exempted by New Jersey law.

New Jersey sales tax information is available from the NJ Treasury Division of Taxation.

Illinois

Median rent in major metropolitan areas

Chicago Metropolitan Area:

Chicago is the largest and most important city in Illinois and one of the largest cities in the United States. The Chicago metropolitan area is centered around the city of Chicago, and includes the city’s suburbs and adjacent suburbs from Indiana and Wisconsin. Chicago is a center of finance, manufacturing, transportation, culture, education, and tourism, and is home to world-famous buildings and museums. O’Hare International Airport is also located in this metropolitan area, making it an international transportation hub. The median monthly rent in Chicago, Naperville, and Elgin is $2,383.

Income Tax

Illinois’ personal income tax rate is a flat rate of 4.95%. Unlike the federal government and many other states, Illinois does not have tax brackets that impose higher tax rates on people who earn more.

Illinois state income taxes are paid to the Illinois Department of Revenue.

Sales Tax

The basic sales tax rate in Illinois is 6.25%. The sales tax rate is the sum of the state, county, and city sales tax rates.

Chicago’s 10.25% sales tax rate consists of 6.25% Illinois sales tax, 1.75% Cook County sales tax, 1.25% Chicago tax, and 1% special tax.

Illinois sales and use tax information is available from the Illinois Department of Revenue.

Florida

Median rent in major metropolitan areas

Miami Metropolitan Area:

Miami is Florida’s largest and most cosmopolitan city, with strong ties to Latin America and the Caribbean. This metropolitan area is centered around the city of Miami and includes Fort Lauderdale and West Palm Beach. Tourism, international trade, finance and real estate are the main industries, and it is characterized by beautiful beaches and cultural diversity. The median monthly rent in Miami, Fort Lauderdale, and Pompano Beach is $2,930.

Orlando Metropolitan Area:

Orlando is located in Central Florida, and tourism is the main industry. There are many theme parks, including Walt Disney World Resort and Universal Orlando Resort. Orlando also has a thriving aerospace industry and higher education institutions. The median monthly rent in Orlando, Kissimmee, and Sanford is $2,110.

Income Tax

Florida does not impose individual income taxes. This means that people living in Florida do not have to pay state income taxes. However, federal income tax still applies.

Sales Tax

In Florida, sales tax is levied on goods and some services. Florida’s basic sales tax rate is 6%, but sales tax rates are not uniform across the state and vary by local government.

For example, Miami’s 7% sales tax rate is made up of 6% Florida sales tax and 1% Miami-Dade County sales tax. Orlando’s sales tax rate is 6.5%, which is the same as the minimum total sales tax rate.

Florida’s absence of an income tax means a focus on sales tax within the state.

Oregon

Median rent in major metropolitan areas

Portland Metropolitan Area:

Portland is Oregon’s largest city and is located in northwestern Oregon. This metropolitan area is centered around the city of Portland and includes Hillsboro, Baberton, Gorges, and Vancouver (Washington State). Portland is known for its sustainability, bike culture, craft beer, and beautiful natural surroundings (including the Columbia River Gorge and Mount Hood). It also has a highly developed technological industry and is rich in diverse cultural events and food culture. The median monthly rent in the Portland metropolitan area is $2,264.

Income Tax

Oregon individual income tax rates are: The top tax rate is 9.9%.

| Tax rate | Single/Married filing separately | Income tax |

| 4.75% | $0 to $3,750 | 4.75% x taxable income |

| 6.75% | $3,751 to $9,450 | $178 plus x 6.75% over $3,750 |

| 8.75% | $9,451 to $125,000 | $563 plus 8.75% over $9,450 |

| 9.9% | over $125,000 | $10,674 plus 9.9% over $125,000 |

| Tax rate | Married filing jointly | Income tax |

| 4.75% | $0 to $7,500 | 4.75% x taxable income |

| 6.75% | $7,501 to $18,900 | $356 plus x 6.75% over $7,500 |

| 8.75% | $18,901 to $250,000 | $1,126 plus 8.75% over $18,900 |

| 9.9% | over $250,000 | $21,347 plus 9.9% over $250,000 |

Oregon personal income tax information is available from the Oregon Department of Revenue.

Sales Tax

Oregon does not impose sales tax. This means that there is no sales tax in Oregon, and no sales tax is levied on the sale of goods or services.

Instead, Oregon uses income tax as its primary tax and uses the revenue as a source of state revenue.

Massachusetts

Median rent in major metropolitan areas

Boston Metropolitan Area:

Boston is the largest city in Massachusetts and the cultural and economic center of the New England region. The Boston metropolitan area is centered around the city of Boston and includes Cambridge, Newton, Quincy, and Brookline. Boston is home to high-quality educational institutions (such as Harvard University and the Massachusetts Institute of Technology) and medical institutions (such as Massachusetts General Hospital), as well as advanced technology, financial, and biotechnology industries. The median monthly rent in the Boston metropolitan area is $3,884.

Income Tax

For the 2022 tax year, Massachusetts imposes a 5.0% tax on both earned (salaries, wages, tips, and commissions) and unearned income (interest, dividends, and capital gains). The tax rate on long-term capital gains is 12% (net of 50%).

Massachusetts income taxes are paid to the Masachusetts Department of Revenue.

Sales Tax

Massachusetts has a state sales tax rate of 6.25% and no local sales tax.

Massachusetts has two classifications: Business Sales & Use Tax and Sales Use Tax for Individual. Sales and use tax information is available from the Massachusetts Department of Revenue.

Comment